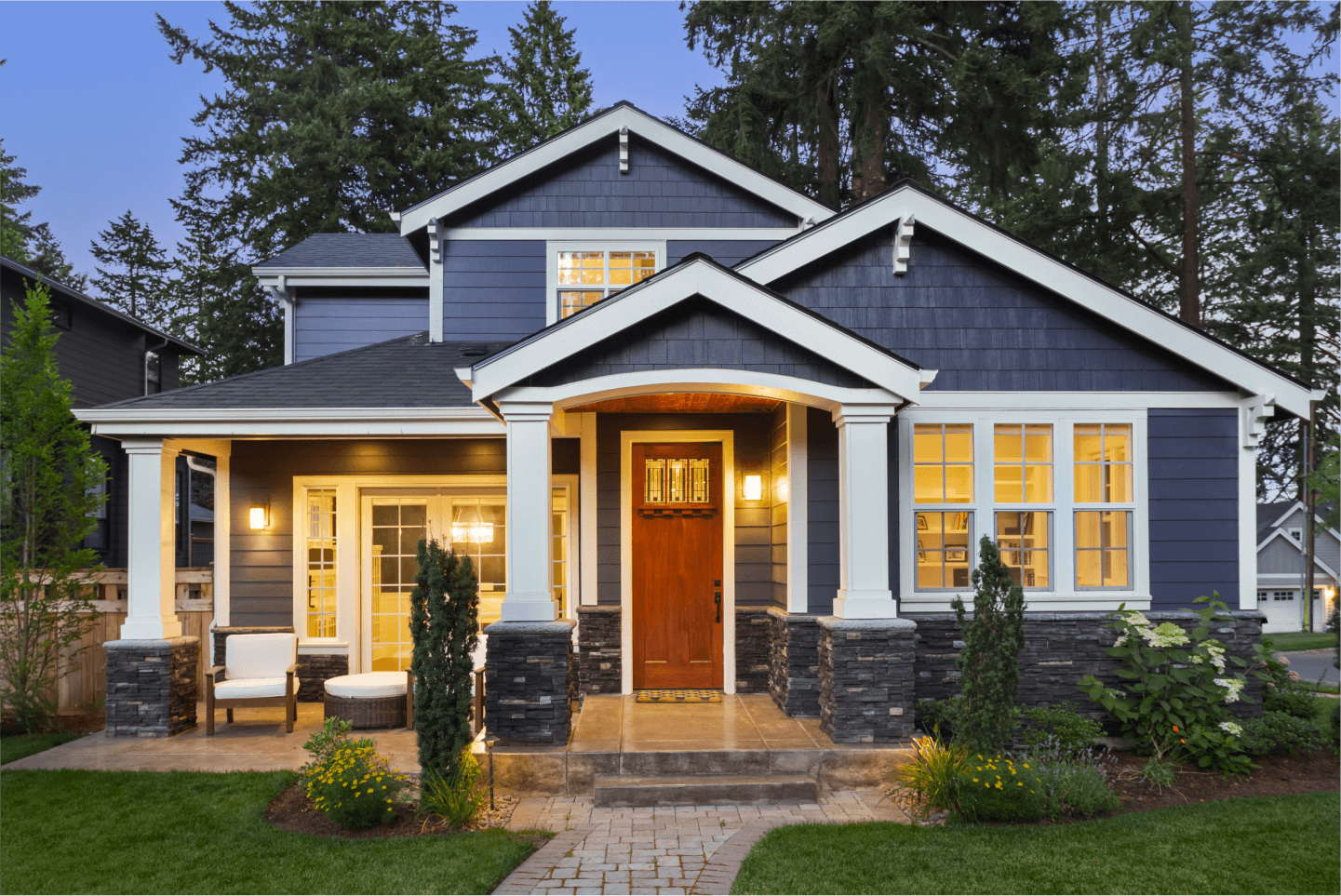

FHA Loans Made Easy: Financing Your Dream Home

Ready to turn your dream home into a reality? Discover how FHA loans simplify the mortgage process, making homeownership easier than ever!

Ready to transform your dream home into a reality? Look no further than FHA loans, the solution that can simplify the mortgage process and make homeownership easier than ever before. Whether you're a first-time buyer or looking to upgrade, understanding the benefits of FHA loans can give you the confidence you need to secure your dream property.

One of the significant advantages of FHA loans is the low down payment requirement. With as little as 3.5% down, you can step into your dream home faster than you ever thought possible. This lower down payment allows you to save your hard-earned money while still being able to afford a quality, comfortable residence. In addition, these loans often have more lenient credit score requirements than traditional mortgages, making them accessible to a wider range of borrowers.

FHA loans are also renowned for their flexibility. Whether you're interested in a single-family home, condominium, or even a fixer-upper, FHA loans can accommodate your needs. The flexibility extends to the mortgage insurance as well, as FHA loans offer both upfront and annual mortgage insurance premiums. These options allow borrowers to choose the structure that best suits their financial circumstances, giving you more control over your monthly mortgage expenses.

In conclusion, FHA loans open the doors to homeownership by simplifying the mortgage process and offering an array of benefits for borrowers. The low down payment requirement and flexible options make it easier than ever to finance your dream home. So take that leap of faith and secure an FHA loan today – it could be the first step towards a brighter future in your very own home.